Introducing the Payment Options Partner Program – a rewarding opportunity for individuals like you to partner with us and earn commissions by referring our seamless payment solutions to your existing client base. As businesses continue to move towards online and contactless payment methods, there’s no better time to tap into this growing demand and offer your clients the tools they need to succeed.

Why Partner with Payment Options?

As a partner, you’ll be part of an industry-leading provider of payment solutions. We offer a range of tools designed to help businesses streamline their payment processes and improve efficiency. From secure payment gateways to simple subscription plans and contactless QR code and payment link solutions, we provide businesses with everything they need to succeed in today’s competitive market.1. Earn Commission for Every Referral

For every successful referral, you’ll earn a commission! By connecting your network of small and medium-sized businesses (SMEs) with our payment solutions, you can start earning extra income with minimal effort. We handle the technical side of things, ensuring that your clients receive the best-in-class service, while you reap the benefits of the referrals.2. Offer Payment Solutions That Increase Efficiency

Our payment solutions are designed with ease and efficiency in mind, and your clients will love how easy it is to accept payments. From online payment gateways to subscription plans and QR code payments, our products are perfect for SMEs and small businesses looking to optimize their payment processes and grow. You’ll be offering solutions that are seamless and built for the future.3. No Tech Expertise Required

Don’t worry about needing in-depth technical knowledge. Our team will provide you with all the tools and resources necessary to understand our products and share them confidently with your clients. We also offer extensive customer support to ensure that both you and your clients are well taken care of.4. Expand Your Network and Influence

Joining the Payment Options Partner Program allows you to further build your reputation and expand your influence. By offering a solution that helps your clients improve their business operations, you’ll become a valuable resource for them. This can lead to more referrals, new business opportunities, and stronger relationships with clients.How Does It Work?

1. Sign Up as a Partner: The first step is simple – register for our Partner Program and gain access to all the resources you need to start referring clients.2. Refer Your Clients: Introduce our payment solutions to your clients. We offer a range of flexible, scalable options that are perfect for businesses of all sizes.

3. Earn Commissions: Once your referrals sign up and start using our solutions, you’ll begin earning commissions for each successful referral.

4. Enjoy Ongoing Support: We’ll support you every step of the way with dedicated resources, training, and customer service to ensure you and your clients have a smooth experience.

Ready to Start Earning with Payment Options?

The Payment Options Partner Program offers an exciting opportunity to increase your income by referring trusted, in-demand payment solutions to your clients. By leveraging your existing connections to SMEs and small businesses, you can tap into a new revenue stream while helping your clients optimize their payment processes.Don’t miss out on this opportunity. Join the Payment Options Partner Program today and start earning while providing value to your clients!

As Singapore’s e-commerce sector grows, understanding the intricacies of various payment methods is crucial for businesses aiming to thrive in the digital marketplace. To explore the significance of diverse payment methods, read on to find out what the top 5 Major Payment Methods are in Singapore, and how to decide which is the best for your business.

Payment methods refer to the different means through which transactions are processed between buyers and sellers in online transactions. These methods include a wide array of options, from traditional credit and debit cards to emerging digital wallets and online banking transfers. Each method comes with its advantages and considerations, influencing how your business operates in Singapore.

1. Cards

Card payments are payments done using a debit or credit card, that is used to withdraw funds for payment of goods and services. The funds are directly deducted immediately (debit), or delayed (credit), from the buyer’s account, depending on the type of card.

BenefitsThey are fast and efficient, requiring only a short time for your business to receive the money. The process of payment does not take long. The buyer only has to key in their credit card details and go through a security card checkout process. They can also simply tap or insert their card into a card reader. This ensures that payments are secure, as it provides for advanced encryption and fraud detection, protecting your business. Here are the major cards used in Singapore:

- Visa

- MasterCard

- American Express

- UnionPay International

Some considerations that come with card payments are the need for a card reader. Card readers can differ in cost, according to the type of reader and the company manufacturing it. Fees may also be charged monthly or annually. Additionally, transaction fees are also required by the business to process customer payments, which also depend on the provider of the cards.

2. Bank Transfers

Bank Transfer refers to the transfer of funds between two banks, from one to another. It can be done online or mobile, requiring the customer to key in their bank account details, the amount they want to transfer, and the date of payment.

BenefitsAs bank transfers occur between two banks, it is secure and safe, and cannot be intercepted by other parties. Hence, protecting the business from being susceptible to fraud. The majority of bank transfers in Singapore are facilitated by PayNow, which allows transfers among the following major financial institutions and more:

- DBS Bank/POSB

- OCBC Bank

- United Overseas Bank (UOB)

- CitiBank Singapore Limited

- HSBC

Since bank transfers happen manually, there is a possibility to be susceptible to human error. For example, if the account details or amount transferable is being keyed in incorrectly, it is not possible to reverse the transaction and will be very difficult to retrieve the funds transferred. Banks also do not control the transactions, and transfers lack protection against fraudsters.

3. QR Code Payments

QR Code payments take place when customers scan a QR code using their smartphone camera. They will either be led to confirm payment, or to a payment page where the customer chooses their method of payment.

There are 2 main types of QR codes, namely static and dynamic. Static QR codes allow the customer to key in the amount manually. Dynamic QR codes specify the amount paid by the customer, as pre-filled by the merchant.

BenefitsQR code payments do not require very specialised equipment, unlike card payments, which require a card reader, reducing the costs of operations. This makes implementation easier and more efficient as well. QR codes are fast and convenient for both the buyer and seller, increasing customer satisfaction and revenue. It is also secure due to the smartphone’s security features. In Singapore, the Singapore Quick Response Code (SGQR) launched in 2018, was the first of its kind to unify various QR codes under a common one.

ConsiderationsWhile QR codes have many benefits, they are not without faults. They are reliant on having good network connectivity, as poor connection may lead to failure of transactions. Other than this, QR codes are susceptible to fraud and fake QR codes, leading to phishing and scams.

This can put customers at risk and affect business operations. Customers who do not own smartphones or lack access to the technology will also face difficulty in adopting QR code payments.

4. Digital Wallets

Digital Wallets are digital versions of the physical wallet, containing money on digital apps or smartphone platforms. They can be used to send money to recipients, or by holding their smartphone against the seller’s card reader for payment.

BenefitsDigital wallets make paying faster and more convenient. Customers do not have to bring around or search through their physical wallets during payment. This leads to higher checkout conversions for businesses, increasing the smoothness of transactions. Digital wallets are also equipped with security features and advanced security technologies, protecting customers’ information and reducing fraud for merchants. Hence, mobile wallet usage has been on the rise in Singapore, with the following being the most used:

- GrabPay

- FavePay

- Singtel Dash

- ShopeePay

However, accepting payment by digital wallets means businesses require certain technology and equipment, including a payment gateway, increasing costs. As technology and features of the wallets evolve, merchants also need to update integrations, to stay up to date and reduce disruptions. Digital wallets also have higher interchange fees as compared to card payments, with possible processing fees as well.

5. Buy Now, Pay Later (BNPL)

Buy Now, Pay Later (BNPL) allows customers to pay for goods and services in instalments without interest charges, instead of paying the full cost upfront. Customers will then repay a certain amount every month.

BenefitsMerchants receive the full payment upfront, instead of in instalments, as the customers deal with the BNPL provider rather than the merchant. This protects merchants from repayment risk and fraud. It also puts businesses at ease, as the BNPL provider takes over the risk from merchants. BNPL provides a more flexible payment arrangement for buyers, incentivising them to make purchases, and helping businesses target a wider customer base. It is less intimidating for customers to make bigger one-time payments, increasing conversion rates and improving orders overall. Here are some of the major BNPL providers in Singapore:

- Atome

- Grab PayLater

- SPayLater

That being said, here are some considerations for businesses when adopting BNPL payment arrangements. BNPL providers do charge higher fees to merchants based on a percentage of the customer’s purchase, in comparison to debit and credit card companies, so it may not be beneficial for businesses just getting by. It might also indirectly affect the business image if the customer had a bad experience with a BNPL provider, resulting in the customer going straight to the merchant and blaming them.

How to Select the Best Payment MethodSo how can businesses select the best payment method for their business? Businesses can consider the cost of operations if a certain payment method is chosen. For example, if card payment was chosen, businesses will need to consider the processing fees involved in relation to the profits, admin and resources needed to run the business.

Businesses can also look at customer preferences, to analyse what are the preferred methods of payment. By adopting them, they can appeal to the ease and convenience of customers.

Another thing to consider is how to minimise failed payment rates, which can be common among credit card payments. It not only creates inconvenience for customers, disincentivising them from returning to the business but also takes time to deconflict and recover payments.

ConclusionChoosing the right payment methods for your business in Singapore is pivotal to enhancing customer convenience, optimizing operational efficiency, and fostering trust in online transactions. Whether you’re considering credit cards, digital wallets, or other emerging options, Payment Options stands ready to support your integration process.

Explore our resources and services on our website to discover how we can help your business navigate and thrive in the evolving e-commerce landscape.

In recent years, Japan has witnessed a significant shift towards digitalization in various aspects of daily life, including payment methods. As one of the world’s most technologically advanced countries, Japan offers a diverse array of digital payment options tailored to the needs and preferences of consumers. In this blog post, we’ll delve into the landscape of digital payment methods in the Japanese market, exploring the trends, innovations, and key players shaping the future of commerce.QR Code Payments

QR code payments have gained immense popularity in Japan, thanks to the widespread adoption of mobile technology and the convenience they offer. Leading the charge are mobile payment services like PayPay, Line Pay, and Rakuten Pay, which allow users to make purchases by scanning QR codes displayed at merchant stores or websites. This cashless payment method has become increasingly prevalent in various retail establishments, restaurants, and even public transportation systems across the country.Mobile Wallets

With the rise of smartphone usage, digital wallet services have become an integral part of the Japanese payment landscape. Apple Pay, Google Pay, and various domestic mobile wallet platforms offer users the convenience of storing their credit or debit card information securely on their smartphones and making contactless payments at compatible terminals. The seamless integration of smartphone wallets with popular transit systems like Suica and Pasmo further enhances their appeal, enabling users to pay for transportation fares effortlessly.Bank Transfers and Direct Debit

While digital payment methods such as QR code payments and smartphone wallets dominate the retail sector, bank transfers and direct debit remain prevalent in online transactions and bill payments. Japanese consumers often opt for bank transfers when making purchases from online retailers or settling utility bills, leveraging the convenience of internet banking platforms offered by their financial institutions. Direct debit services provided by banks and payment service providers also enable recurring payments for subscription services, insurance premiums, and more.Prepaid Cards and E-Money

Prepaid cards and electronic money (e-money) have emerged as convenient alternatives to cash and traditional payment methods in Japan. Suica, Pasmo, and ICOCA are popular prepaid cards commonly used for transportation, while e-money services like Nanaco and Edy are widely accepted at convenience stores, supermarkets, and vending machines. These reloadable cards and e-money platforms offer users flexibility and ease of use, making them ideal for everyday purchases and travel expenses.Contactless Technology

Contactless payment technology, including NFC (Near Field Communication) and RFID (Radio-Frequency Identification), is becoming increasingly prevalent in Japan, particularly in retail and hospitality industries. Merchants are adopting contactless payment terminals to accommodate the growing demand for cashless transactions, offering customers a convenient and hygienic payment experience. As Japan prepares to host major international events like the Tokyo Olympics, the adoption of contactless technology is expected to accelerate further, driving innovation and enhancing the overall payment ecosystem.In conclusion

The Japanese market offers a rich tapestry of digital payment methods tailored to the preferences of tech-savvy consumers. From QR code payments and mobile wallets to prepaid cards and contactless technology, the landscape of digital payments continues to evolve, driven by innovation and consumer demand. At Payment Options, we’re committed to helping businesses navigate the complexities of the Japanese market and leverage the latest digital payment solutions to drive growth and enhance the customer experience.Join us as we embrace the future of commerce in Japan and beyond.

In the fast-paced world of e-commerce, efficiency is key. From attracting customers to managing inventory, every aspect of your online store should be optimized for seamless operation. One critical component of this optimization is payment gateway integration. By integrating a reliable payment gateway into your e-commerce platform, you can streamline the checkout process, improve customer satisfaction, and ultimately boost sales. In this article, we’ll explore the importance of payment gateway integration and how it can enhance the efficiency of your e-commerce business.

Understanding Payment Gateway Integration

First, let’s clarify what payment gateway integration entails. A payment gateway is a technology that facilitates online transactions by securely authorizing payments between merchants and customers. Integration refers to the process of connecting the payment gateway to your e-commerce platform, allowing for smooth and secure transactions to take place.Streamlining the Checkout Process

One of the primary benefits of payment gateway integration is the ability to streamline the checkout process. With an integrated payment gateway, customers can complete their transactions quickly and easily, without being redirected to external websites or encountering unnecessary hurdles. This seamless experience not only improves customer satisfaction but also reduces cart abandonment rates, ultimately leading to higher conversion rates and increased revenue.Enhancing Security Measures

Security is a top priority for any e-commerce business, and payment gateway integration plays a crucial role in ensuring the safety of online transactions. Integrated payment gateways employ advanced encryption and fraud detection measures to protect sensitive customer information, such as credit card details, from unauthorized access or theft. By leveraging these security features, you can instill trust in your customers and reassure them that their personal data is in safe hands.Providing Flexibility and Convenience

Another advantage of payment gateway integration is the flexibility and convenience it offers to both merchants and customers. Integrated payment gateways support a wide range of payment methods, including credit cards, debit cards, digital wallets, and alternative payment options. This variety allows you to cater to the preferences of diverse customer segments and expand your reach to global markets. Additionally, integration enables automated processes such as recurring billing for subscription-based services, saving time and effort for both you and your customers.Maximizing Insights and Analytics

Finally, payment gateway integration provides valuable insights and analytics that can help you optimize your e-commerce operations. Integrated payment gateways generate detailed reports on transaction volumes, payment trends, and customer behavior, allowing you to identify areas for improvement and make data-driven decisions. By leveraging these insights, you can refine your marketing strategies, enhance product offerings, and drive overall business growth.Conclusion

In conclusion, payment gateway integration is essential for enhancing the efficiency and effectiveness of your e-commerce business. By seamlessly connecting your online store to a secure and reliable payment gateway, you can streamline the checkout process, improve security measures, provide flexibility and convenience to your customers, and maximize insights and analytics. Whether you’re a small boutique or a large enterprise, investing in payment gateway integration is a smart decision that can drive success in today’s competitive e-commerce landscape.Ready to elevate your e-commerce experience? Contact us today to learn more about our seamless payment gateway integration solutions.

What is Payment Gateway API?

Payment Gateway API, or Application Programming Interface, serves as the bridge between a merchant’s website or application and the payment processing network. It enables developers to integrate payment gateway services seamlessly into their platforms. By leveraging Payment Gateway APIs, businesses can securely accept a variety of payment methods, including credit cards, debit cards, and digital wallets, without the need for customers to leave the website or application.

How does Payment Gateway API Work?

- Payment Request: When a customer pays, the platform sends a request to the API.

- Secure Transmission: The API sends payment details securely to the processor.

- Authorization: The processor verifies the transaction with the bank.

- Transaction Processing: If approved, the processor deducts the payment.

- Response Handling: It sends a response to the API with the transaction status.

- Customer Notification: The API informs the platform of the status.

- Transaction Settlement: Finally, the processor transfers funds to the merchant.

Benefits of Payment Gateway API

Enhanced User Experience

Integrating Payment Gateway APIs makes checkout smoother and boost conversions by avoiding separate payment pages.

Increased Security

Payment Gateway APIs ensure data safety through encryption and tokenization.

Flexibility and Customization

Businesses can tailor payment methods and checkouts to match their brand.

Streamlined Payment Processing

Automating payment workflows reduces errors and manual tasks, while real-time monitoring helps manage payments efficiently.

What is Pay By Link?

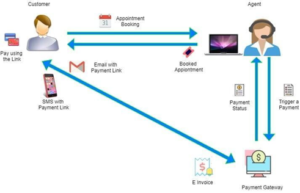

Pay by Link is a dynamic online payment method that simplifies the payment process for businesses and customers. Here are the key steps in the pay-by-link process:

- Generate Payment Link: The merchant uses their payment solution to generate a payment link.

- Share Payment Link: The payment link is shared with the customer through various channels such as email, SMS, or other communication platforms.

- Customer Receives Link: The customer receives the payment link on their preferred communication channel.

- Customer Clicks on Link: The customer clicks on the provided link.

- Redirect to Secure Payment Page: The customer is redirected to a secure payment page where they can complete the transaction.

- Payment Method Selection: The customer can choose from various payment methods, including credit/debit cards, digital wallets, or bank transfers.

- Transaction Confirmation: Once the payment is completed, the merchant receives a notification confirming the transaction.

Benefits of Pay by Link for Merchant

Security

Pay by Link transactions are processed through a secure payment gateway with built-in fraud protection and compliance with standards such as 3DS2 protocol and PCI DSS.

Improved Operations

Reduces overhead costs by eliminating the need for physical point-of-sale card readers and associated fees.

Versatility

Payment links can be shared on various platforms, including social media and messaging apps, allowing for customized promotions and marketing.

Customization

Merchants can set up flexible payment plans, enabling customers to pay in installments.

Reduced Customer Churn

Provides a seamless customer experience with flexible payment options, leading to increased customer satisfaction and loyalty.

Ease of Use

Customers do not need to download additional apps and can quickly complete transactions without entering card details each time.

Built-in Compliance

Payment link service providers adhere to data security standards, ensuring compliance with relevant legislation.

Payment Portability

Customers can make payments from any location and device, providing convenience and accessibility.

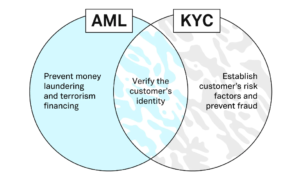

Understanding KYC

KYC refers to “Know Your Customer”. The KYC process is a key part of the overall AML framework and specifically requires organizations to know who they do business with and verify customer identity.

KYC references a set of guidelines that financial institutions and businesses follow to verify the identity, suitability, and risks of a current or potential customer. The goal is to identify suspicious behavior such as money laundering and financial terrorism before it ever materializes.

The 3 components of KYC

- Customer Identification Program – Identify and verify the identity of customers

- Customer Due Diligence Program – Understand the nature and purpose of customer relationships to develop customer risk profiles

- Continuous Monitoring – Conduct ongoing monitoring to identify and report suspicious transactions and on a risk basis, maintain and update customer information

How much does KYC cost businesses?

Other than the cost of implementing AML-KYC compliance technology and operation processes, there are also other costs such as increased time investment and higher customer churn.

However, non-compliance with KYC processes can increase costs as well. Failing to meet KYC requirements can lead to increasingly steep fines.

What is PCI DSS?

PCI DSS stands for Payment Card Industry Data Security Standard. It is a cybersecurity standard backed by all the major credit card and payment processing companies that aims to keep credit and debit card numbers safe.Payment security is important for every merchant, financial institution, or other entity that stores, processes, or transmits cardholder data. It is vital that every entity responsible for the security of cardholder data diligently follows the PCI Data Security Standards.

What is Payment Security?

Payment security refers to the protective measures and technologies employed in financial transactions to safeguard sensitive information, such as credit card details, from unauthorized access or theft. This includes encryption for secure data transmission, the use of secure websites (https://), two-factor authentication, tokenization to replace actual card numbers, regular transaction monitoring, and maintaining up-to-date software to ensure a robust defense against potential security threats.As a merchant, what can you do to have better payment security?

• Buy and use only approved PIN entry devices at your points-of-sale• Buy and use only validated payment software at your POS or website shopping cart

• Do not store any sensitive cardholder data in computers or on paper

• Use a firewall on your network and PCs

• Make sure your wireless router is password-protected and uses encryption

• Use strong passwords. Be sure to change default passwords on the hardware and software – most are unsafe

• Regularly check PIN entry devices and PCs to make sure no one has installed rogue software or “skimming” devices

• Teach your employees about security and protecting cardholder data

• Follow the PCI Data Security Standard

Where can you get more information on PCI DSS?

To understand more on the security standards and requirements, you may visit https://www.pcisecuritystandards.org/merchants/ for more information.

What is a Hosted Payment Page?

A hosted payment page is a web page, hosted by a third party, that provides secure checkout capabilities for business websites. It allows businesses that accept online payments to avoid building—and then managing—their own payment gateways on their websites.

How does Hosted Payment Page work?

When your eCommerce customer initiates the final transaction, our payment gateways will redirect them from the checkout page to the payment service provider (PSP) page for entering payment details. Subsequently, they will return to our website to complete the checkout process.

Benefits of Hosted Payment Page

1. Versatility

Hosted solution offers versatile procedures for acquiring and handling payments through the eCommerce payment gateway, ensuring flexibility.

2. Privacy Protection

The payment gateway safeguards credit cardholders’ privacy during payment processing.

3. Ease of Setup

Setting up the system is simple, involving integration of the site with the hosting page to start accepting payments.

4. Convenient Reference

Easy access to previous purchases and a straightforward refund procedure without exposing sensitive card information.

5. Universal device compatibility

Hosted payment pages are designed to work with every device your customers use to shop.

Speak with us to learn how Payment Options can help your business accept payments and leverage on hosted payment page to accelerate your business.