Navigating KYC: A Guide to Understanding Know Your Customer Requirements

Understanding KYC

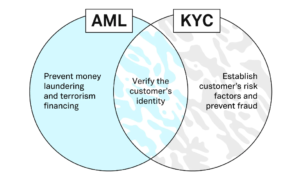

KYC refers to “Know Your Customer”. The KYC process is a key part of the overall AML framework and specifically requires organizations to know who they do business with and verify customer identity.

KYC references a set of guidelines that financial institutions and businesses follow to verify the identity, suitability, and risks of a current or potential customer. The goal is to identify suspicious behavior such as money laundering and financial terrorism before it ever materializes.

The 3 components of KYC

- Customer Identification Program – Identify and verify the identity of customers

- Customer Due Diligence Program – Understand the nature and purpose of customer relationships to develop customer risk profiles

- Continuous Monitoring – Conduct ongoing monitoring to identify and report suspicious transactions and on a risk basis, maintain and update customer information

How much does KYC cost businesses?

Other than the cost of implementing AML-KYC compliance technology and operation processes, there are also other costs such as increased time investment and higher customer churn.

However, non-compliance with KYC processes can increase costs as well. Failing to meet KYC requirements can lead to increasingly steep fines.