The Evolution of Digital Payments: A Cashless Revolution

In today’s fast-paced and interconnected world, technology continues to revolutionize every aspect of our lives, and financial transactions are no exception. Digital payments have emerged as a game-changer, transforming the way we pay for goods and services. Gone are the days of fumbling with physical cash or writing paper checks; now, a simple tap on a screen or a wave of a card can complete a transaction instantly. In this blog, we will explore the concept of digital payments, their evolution, benefits, challenges, and the future they hold for the global economy.

Understanding Digital Payments

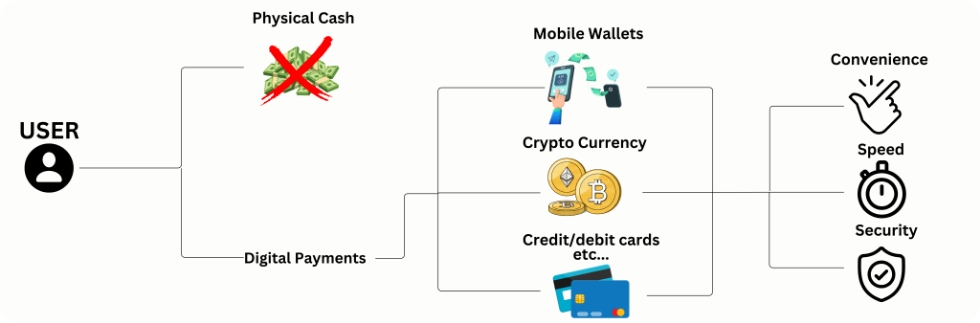

Digital payments, also known as electronic payments or cashless transactions, refer to any financial transaction conducted electronically, without the involvement of physical cash. These transactions can occur through various digital channels such as credit/debit cards, mobile wallets, online banking, electronic funds transfers (EFT), and even cryptocurrency. The primary goal of digital payments is to enhance convenience, speed, and security in conducting financial transactions.

The Evolution of Digital Payments

The journey of digital payments began several decades ago with the advent of credit cards and ATMs. These innovations significantly reduced reliance on cash and offered consumers greater flexibility in managing their finances. However, it was not until the late 20th and early 21st centuries that the real transformation occurred with the rise of the internet and mobile technologies.

- Online Banking

Online banking platforms enabled consumers to access their accounts, view transaction history, and transfer funds without visiting a physical branch. This was a significant step toward the digitization of finance.

- E-Commerce

The growth of online shopping necessitated secure digital payment methods. Credit and debit cards became the primary instruments for conducting transactions on e-commerce platforms.

- Mobile Payments

With the widespread adoption of smartphones, mobile payment solutions like Apple Pay, Google Pay, and Samsung Pay emerged. These platforms allowed users to make payments directly from their mobile devices, further reducing the reliance on physical cards.

- Peer-to-Peer (P2P) Payments

Services like PayPal, Venmo, and Cash App allowed individuals to transfer money directly to one another, making splitting bills or sending money to friends and family more convenient.

- Cryptocurrencies

The introduction of Bitcoin in 2009 marked the beginning of a new era in digital payments. Cryptocurrencies, built on blockchain technology, promised decentralized and secure transactions, challenging traditional financial systems.

Benefits of Digital Payments

The widespread adoption of digital payments has brought forth numerous advantages, benefiting consumers, businesses, and economies alike.

- Convenience

Digital payments offer unparalleled convenience. With just a few taps on a smartphone or a click on a computer, transactions can be completed instantly, irrespective of geographical boundaries.

- Security

Compared to carrying cash, digital payments provide a higher level of security. Encryption and tokenization protect sensitive financial information, reducing the risk of fraud and theft.

- Real-time Tracking

Digital transactions offer detailed records, allowing users to track their spending habits and better manage their finances. Businesses can gain valuable insights into customer behavior through these data.

- Financial Inclusion

Digital payments have the potential to promote financial inclusion, as they offer easier access to financial services for those who may not have had access to traditional banking systems.

- Cost Efficiency

For businesses, accepting digital payments can reduce operational costs associated with handling physical cash and processing checks.

Challenges and Concerns

While digital payments present numerous advantages, they also come with their fair share of challenges and concerns that must be addressed to ensure their widespread acceptance and safe implementation.

- Security Risks

As digital transactions increase, so do the risks of cybersecurity threats and data breaches. Ensuring robust security measures becomes paramount to safeguard user information.

- Technological Infrastructure

In some regions, the lack of adequate technological infrastructure can hinder the seamless adoption of digital payment solutions, especially in rural and remote areas.

- Digital Divide

The digital divide, the gap between those who have access to technology and the internet and those who don’t, can exacerbate financial exclusion in certain communities.

- Privacy Concerns

The collection of vast amounts of user data during digital transactions raises concerns about privacy and how this information is used by financial institutions and third-party providers

- Consumer Education

As digital payments continue to evolve, educating consumers about the various options, security best practices, and potential risks is essential to build trust and ensure responsible usage.

The Future of Digital Payments

The future of digital payments appears promising, with continued advancements in technology and changing consumer preferences driving innovation. Here are some key trends that may shape the future of cashless transactions:

- Biometric Authentication

Biometric authentication, such as fingerprint and facial recognition, offers an additional layer of security and convenience for digital payment users.

- Internet of Things (IoT) Payments

As more devices become connected to the internet, IoT payments will enable seamless and automated transactions between smart devices.

- Central Bank Digital Currencies (CBDCs)

Several countries are exploring the possibility of issuing their digital currencies, CBDCs, which could revolutionize the concept of money and payments.

- Blockchain and Cryptocurrencies

The integration of blockchain technology and cryptocurrencies into mainstream financial systems could enhance transparency and security in digital transactions.

- Contactless and Wearable Payments

Contactless payment options, including wearable devices like smartwatches and fitness bands, will likely become more popular, eliminating the need for physical cards.

Conclusion

Digital payments have come a long way from their inception, transforming the global financial landscape. The convenience, security, and cost-efficiency they offer have led to their widespread adoption across various industries. However, the challenges of security, digital divide, and privacy concerns must be addressed to ensure a sustainable and inclusive cashless future. As technology continues to evolve, so will digital payments, reshaping the way we conduct financial transactions and ushering us into a new era of financial innovation and connectivity.