Demystifying Interchange++ Payments: Understanding the Transparent Pricing Model

In the realm of payment processing, the landscape has evolved considerably, offering businesses a variety of options when it comes to accepting payments. One such model gaining traction is Interchange++, a transparent pricing structure that promises businesses more control and insight into their transaction costs. In this blog post, we will delve into the world of Interchange++ payments, exploring how this pricing model works, its advantages, and why businesses are increasingly adopting it.

Understanding Interchange++ Payments:

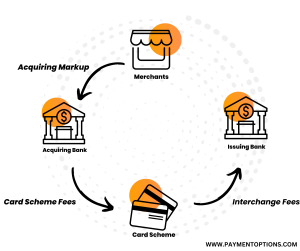

Interchange++ is a pricing model used in payment processing, particularly in the credit card industry. It combines two main components: interchange fees and a markup or percentage added by the payment processor. Let’s break down each component:-

- Interchange Fees:Interchange fees are charges that banks or card issuers impose on businesses for processing credit card transactions. These fees vary based on factors such as card type (debit, credit), transaction amount, industry, and whether the card is present during the transaction. Interchange fees are standard across the industry and are set by card networks like Visa, Mastercard, and others.

- Markup or Percentage:In the Interchange++ model, payment processors add a markup or percentage on top of the interchange fees to cover their services. This markup includes the processor’s profit and covers various services, including transaction processing, fraud prevention, customer support, and technology infrastructure.

Advantages of Interchange++ Payments:

- Transparency:One of the key advantages of Interchange++ is transparency. Businesses can see the actual interchange fees charged by card networks and the exact amount of markup added by the payment processor. This transparency helps businesses understand the true cost of accepting different types of cards.

- Cost Savings:Interchange++ can lead to potential cost savings for businesses, especially those with a high volume of transactions. By having a clearer picture of interchange fees, businesses can make informed decisions about which cards to accept and implement strategies to optimize costs.

- Customization and Control:Interchange++ allows businesses to customize their pricing strategy based on their specific needs. They can choose to pass on interchange savings to customers, absorb some fees to attract sales, or adjust pricing based on their profit margins.

- Incentive for Efficiency:Since businesses can directly see the impact of interchange fees, there is an incentive to optimize operations and encourage customers to use cost-effective payment methods, potentially reducing overall transaction costs.

- Predictability:While interchange fees can vary, they are well-documented and relatively stable. This predictability can help businesses plan and budget more effectively.